The power of technical indicators in the success of cryptocurrency trade

Cryptocurrency markets have experienced significant growth and volatility in recent years, which makes them a difficult space to navigate. As a result, merchants constantly seek ways to improve their chances of success. An effective strategy that has proven to be very successful is to use technical indicators in cryptocurrency trade.

** What are technical indicators?

The technical indicators are mathematical calculations used to analyze the movements and patterns of price in financial markets, including cryptocurrencies. These indicators provide valuable information about market trends and help merchants make informed decisions about the purchase or sale of assets. By combining multiple technical indicators with other forms of analysis, merchants can obtain an integral understanding of the cryptocurrency market.

Types of technical indicators

There are severe types of technical indicators that merchants use to analyze cryptocurrency markets. Some popular include:

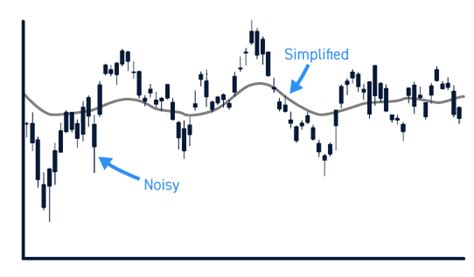

- Mobile averages (MAS) : Mas records the average price of an asset during a specific period, providing a balance between short and long term trends.

- Relative Force Index (RSI) : RSI measures the magnude of recent price changes to determine overcompra or overall conditions in the market.

- Stochastic oscillator : This indicator compares the closing price of an asset with its price range during a specific period, providing information on the resistance of the trend and potential reversions.

- Bollinger bands : These bands consist of two mobile averages drawn at 20 distance periods, providing visual representation of volatility and trend changes.

How to use technical indicators in cryptocurrency trade

The use of technical indicators can be a powerful tool for cryptocurrency merchants. Here are some strategies that incorporate technical indicators:

- Identify trends : Use more to identify long -term trends in the market. An increase in the line indicates a bullish trend, while a line fall suggests a bearish trend.

- Monitor RSI and Stochastic oscillator

: These indicators can help you measure overload conditions or in the market. If the RSI is above 70, it may be time to sell, and if the stochastic oscillator is below 20, the market is likely to have reached a background.

- Track volatility : Bollinger bands can help you monitor prices volatility and potential revsals. When the bands are reduced or expanded, it can indicate greater volatility.

- Use indicator crossovers : When an indicator begins to cross over another, it can be a signal for a possible purchase or sale opportunity.

Benefits of the use of technical indicators

The use of technical indicators in the cryptocurrency trade offers several benefits, which include:

- Improved precision : Technical indicators can help you identify trends and patterns that may not be evident only through fundamental analysis.

- Reduced risk : By combining multiple indicators with other forms of analysis, merchants can reduce their exposure to risk and increase their chances of success.

- Improved Commercial Strategy : Technical indicators can provide a framework to develop complex commercial strategies that incorporate multiple indicators.

Tips to start

Starting with technical indicators in cryptocurrency trade requires patience and practice. Here are some tips to help you start:

- Start with simple indicators : Start with basic indicators such as more, RSI and stochastic oscillator.

- Combine multiple indicators

: Use multiple indicators together with each other to obtain a more complete understanding of the market.

- Monitor your operations : be attentive to your offices and adjust your strategy accordingly.

4.