“Cryptocurrency and Blockchain Trading: Exploring PoW, Spot Trading, and BLAST”

The world of cryptocurrency trading has experienced a significant surge in popularity over the past decade, with many individuals seeking to capitalize on the rapid growth of digital assets. At the heart of this trend is the use of various blockchain technologies, including Proof of Work (PoW), Spot Trading, and Blast (BLAST). In this article, we will delve into each of these concepts, exploring their underlying mechanics, benefits, and potential risks.

Proof of Work (PoW)

One of the most widely recognized blockchain technologies is PoW. This consensus algorithm, developed by Satoshi Nakamoto in 2009, uses a complex mathematical puzzle to validate transactions and secure the network. In essence, PoW requires miners to solve a difficult mathematical problem, which involves solving a hash function. The first miner to solve the problem gets to add a new block of transactions to the blockchain and is rewarded with newly minted cryptocurrency.

PoW has several benefits:

- Security: PoW provides a secure mechanism for verifying transactions and maintaining the integrity of the blockchain.

- Scalability: PoW enables the creation of larger blocks, which can handle more transactions per second. This scalability is essential for handling high volumes of trades.

- Limited supply: The total number of coins that can be mined is capped at 21 million, ensuring a limited supply of cryptocurrency.

However, PoW also has some significant drawbacks:

- Energy consumption

: Mining requires significant amounts of energy, which contributes to environmental degradation and increased carbon emissions.

- High transaction fees: Transaction fees for mining and validating transactions are often high, making it difficult for small traders to participate in the market.

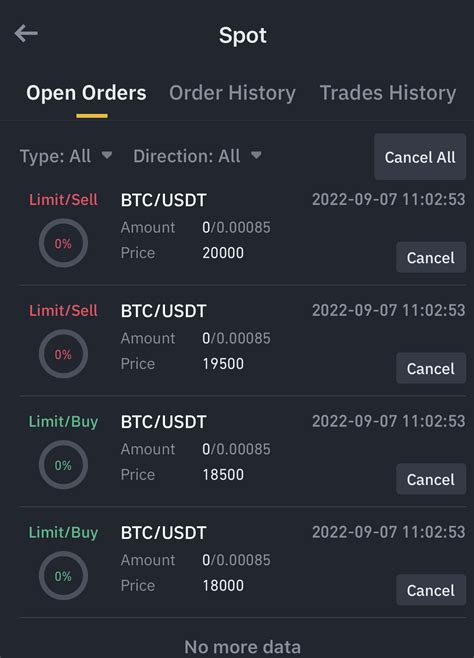

Spot Trading

Spot trading is a popular type of cryptocurrency trading that involves buying or selling cryptocurrencies at a fixed price. Spot markets allow traders to buy and sell assets without having to hold them for an extended period. This makes spot trading ideal for those who want to take advantage of short-term price fluctuations.

Benefits of spot trading:

- Lower risk: Spot trading offers lower volatility compared to other types of trading, making it a more suitable option for beginners or those who are new to cryptocurrency markets.

- Flexibility: Spot traders can quickly respond to changes in market prices and adjust their positions accordingly.

Risks associated with spot trading:

- Market volatility: Spot markets can be highly volatile, leading to significant losses if not managed properly.

- Leverage

: Spots often involve leverage, which means that small price movements can result in larger losses.

BLAST

Blast is a new type of cryptocurrency trading platform that combines the benefits of spot and margin trading. BLAST allows users to buy or sell cryptocurrencies at fixed prices, while also offering margin options for those who want to increase their exposure to the market.

Benefits of Blast:

- Higher leverage: BLAST offers higher leverage compared to traditional trading platforms, allowing users to potentially earn more profits with a smaller investment.

- Increased market coverage: BLAST provides access to multiple markets and cryptocurrencies, giving traders more opportunities to participate in various markets.

Risks associated with Blast:

- Higher risks: BLAST’s high leverage and margin options increase the risk of significant losses if not managed properly.

- Competition: BLAST is a relatively new platform, which means there may be less liquidity and trading activity compared to established players.