Here is a comprehensive article on Cryptocurrencies, Exchanges, and Trading Bots:

Title: “Revolutionizing Finance: Understanding Cryptocurrency Wallets, Exchange-Traded Funds (ETFs), and Trading Bot Strategies”

Introduction

The world of finance has undergone a significant transformation in recent years, with cryptocurrencies like Bitcoin and Ethereum leading the charge. As a result, investors have been seeking new ways to manage their portfolios and make informed investment decisions. Two key technologies that are revolutionizing the financial industry are cryptocurrency wallets and exchange-traded funds (ETFs). Additionally, trading bot strategies have emerged as an attractive option for savvy investors. In this article, we’ll delve into the world of cryptocurrency wallet solutions, ETFs, and trading bot techniques, exploring their benefits, drawbacks, and best practices.

Cryptocurrency Wallets

A cryptocurrency wallet is a digital storage solution that allows users to store, send, and receive cryptocurrencies like Bitcoin and Ethereum. The most popular cryptocurrency wallets are:

- Wallets on Mobile Devices: Apps like MyEtherWallet (MEW), MetaMask, and Ledger Live provide secure mobile wallets for storing cryptocurrencies.

- Desktop Wallets: Software like Electrum, MyEtherWallet, and BitWage offer desktop wallet solutions for managing multiple cryptocurrencies.

- Hardware Wallets: Physical devices like Trezor and Ledger offer secure hardware wallets for storing large amounts of cryptocurrencies.

Benefits of Cryptocurrency Wallets

- Convenience: Cryptocurrency wallets are accessible anywhere with an internet connection, making them a convenient option for investors.

- Security: Most cryptocurrency wallets employ advanced encryption techniques to protect user funds from cyber threats.

- User-Friendly Interface: Many cryptocurrency wallets offer intuitive interfaces, allowing users to easily manage their portfolios.

Exchange-Traded Funds (ETFs)

An ETF is a type of investment fund that tracks the performance of an underlying index or asset class. ETFs are traded on stock exchanges like the New York Stock Exchange (NYSE) and NASDAQ, providing investors with access to a diversified portfolio of assets at a lower cost.

Benefits of ETFs

- Diversification: ETFs offer instant diversification, allowing investors to gain exposure to multiple asset classes without incurring high fees.

- Low Cost: ETFs are often less expensive than actively managed mutual funds, making them an attractive option for income-focused investors.

- Tax Efficiency: ETFs can be more tax-efficient than traditional investment products due to their pass-through taxation structure.

Trading Bot Strategies

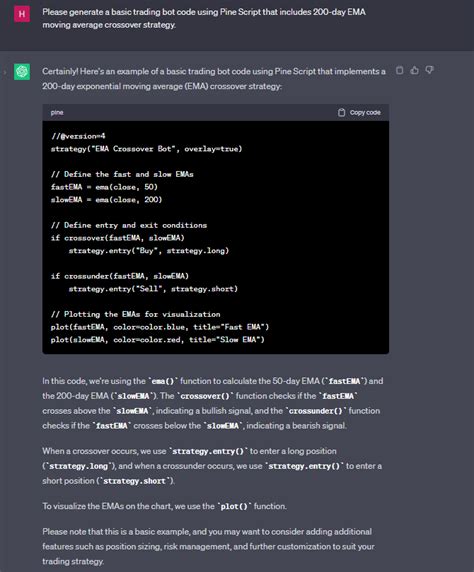

A trading bot is a software program designed to automate the buying and selling of cryptocurrencies based on predefined rules or parameters. Trading bots have become increasingly popular among investors looking to optimize their portfolios with advanced technical analysis.

Benefits of Trading Bot Strategies

- Efficiency: Trading bots can execute trades faster than human traders, reducing overall investment time and minimizing emotional bias.

- Consistency: Automated trading bots ensure consistent portfolio performance, even in the face of market volatility.

- Scalability: Trading bot strategies can handle large volumes of transactions, making them ideal for institutional investors.

Drawbacks of Trading Bot Strategies

- Complexity: Trading bot software requires a basic understanding of technical analysis and programming languages like Python or C++.

- Cybersecurity Risks: Trading bots are vulnerable to cyber threats, which can result in loss of funds or compromised user data.

3.