Tokenomics: Unlocking the Cryptulation of the Cryptum with Offer and Request

In recent years, the Crypto currency has become a global phenomenon, with millions of investors around the world be full to adopt digital currencies such as Bitcoin, Ethereum and others. However, despite the rapid growth, many investors are still scratching their heads when it comes to understanding how crypto currency function. A key concept that plays a vital role in success (or failure) of a crypto currency is a token – a study of the economy basically chips.

What is tokenomics?

Tokenomy is the science of economic token, which includes analysis of the dynamics of offer and demand for digital property. Simply put, this is a way to understand how the cryptocurrency of the currency is generated, maintained and distributed between its users. Tokenomics helps investors better understand potential risks and investment rewards in the cryptocurrency of the currency.

offer and demand

Tokenomics around two basic concepts are spinning in its center: offer and demand.

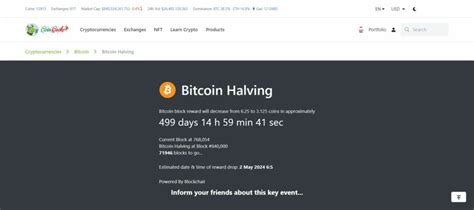

Offer refers to the total amount of chips that created a crypto currency, while

demand

represents the number of users who are willing to buy or trade these chips for other digital assets or FIAT coins.

When the demand is high, the token value tends to increase, and when the demand is low, the value decreases. This dynamics creates a cycle of self -commissioning that can be used by experienced investors who want to make smart financial decisions.

Tyles of Token

There are several types of chips on the CRIPTO CRIPTO market, and each has its own unique features and benefits:

- Service Chips : These chips represent property in a particular project or service. Examples include ERC-20 chips as if (decentralized finances) and USDT (toter).

- Security chips : These chips represent property in a company or business. Examples include chip platforms, such as a joint.

- Play chips : These tokens reward the players to participate in the games or involve the ecosystem of the game. Examples include GAX (Axle Glimini), a crypto currency used for decentralized financial applications (Dead).

Tokenomics and Performance of the Cryptocurrency

Studies have shown that tokenomics play a significant role in determining the success of the crypto currency. A study published by Cryptoslate revealed that:

- Useful chips tend to overcome security chips

- Token games are often good because of great demand and deficiency

- Security tokens on the other hand may be under performance due to regulatory uncertainty

Best Practice for Tokenomics

Investors can benefit from the next best practice when it comes to tokenomic:

- Realize the targeted audience : To know who your users are and what they want will help you create token to respond to their needs.

- Keep an offer in control : Make sure there are enough tokens to buy and trade can help maintain demand and prevent the price volatility.

- Supervision of the market feelings : Follow market trends and feelings can help you adjust your strategy accordingly.

Conclusion

Tokenomics is a critical component of the success of cryptocurrency, as it helps investors know about their investment. Understanding the dynamics of offer and demand for digital property, investors can better sail in the complex world of cryptocurrency markets. Whether you are an experienced investor or simply start, tokenomics provides valuable information about the economy basically cryptocurrencies.

As the cryptocurrency market continues to develop, as well as our understanding of tokenomics. As we progress, it is important that investors remain informed and adjust their strategies to change the landscape.