Understanding order books in the cryptocurrencies market: Deep dive into the depth of the market

Cryptocurrencies such as Bitcoin and Ethereum have experienced enormous growth in recent years. As more and more people are joining the digital world, demand for these cryptocurrencies has increased and prices are raised to unprecedented levels. However, with this growth, market participants’ complex ecosystem, including merchants, investors and institutional investors. One of the critical aspects of the cryptocurrency market is order books that provide valuable insight into market depth and liquidity.

What are your order books?

The order book is an electronic record that monitors the price movements and quantities of cryptocurrencies in real time. It is a critical element of any digital market that allows customers and sellers to replace each other through a stock exchange or market. In the cryptocurrency markets, order books serve as a tool for merchants to make offers (purchase) and bids (selling), influencing prices and market depth.

To understand market depth

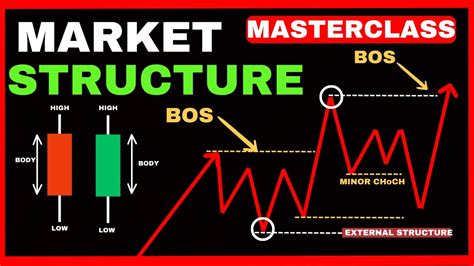

Market depth refers to the level of liquidity of the market, which is measured by the number of transactions at different prices within a given period. This is the index of complexity of the market, deeper markets typically indicate higher liquidity and higher price fluctuations. In the cryptocurrencies market, market depth is particularly important as it can affect prices, trading quantities and general market efficiency.

Types of order books

There are many types of order books that can be found on the cryptocurrencies market:

- Tick size : Fixed interval between successive transactions, defining the minimum size of each trade.

- Price -Growth

: Difference between successive prices, reflecting the rate of volatility.

- Commercial Volume : The number of transactions carried out within a given period that affects the depth of the market.

Order book features

A healthy order book must have many key features:

- High Liquidity

: Sufficient number of buyers and sellers to support more transactions at different prices.

- Competition Market : Rapid transactions to maintain price stability.

- depth : sufficient trade to reflect the real price movements of the market.

Cryptocurrency order book details

Many cryptocurrencies, such as Binance, Coinbase and Kraken, provide data for users:

- Depth of order book : Average number of transactions at different price levels.

- Price Movement : Graphic representation of price changes over time.

- Commercial Volume : A complete amount of transactions carried out within a given period.

Effect on market performance

Understanding the book features of the order is essential for merchants and investors to make well -founded decisions:

- Identification of the price is prone : Analyze your order book data to determine market trends such as signals or sells.

- Trade Strategies : Developing effective trading strategies based on liquidity, price movement and volume of trade.

- Risk Management : Set realistic risk levels and set them according to the book characteristics of your order.

Conclusion

The cryptocurrency markets are complex ecosystems, many participants affect prices and market depth. Ordering books provide critical insight into these dynamics, helping merchants and investors to make sound decisions on entry and exit strategies. By understanding the characteristics of the order book, users can deeper the complexity of cryptocurrency markets and improve their trading performance.

Recommendations

Utilize order books on cryptocurrency markets:

- Use trading platforms : Use reputation platforms to access order book data.

2.