Here is a draft article based on your input:

Ethereum: Filling Limit Orders with Python-Binance API in a Partially Filled Scenario

As a developer using the Python-Binance API, you have probably encountered situations where your limit orders are only partially filled. This can be particularly challenging when working with large or complex market data.

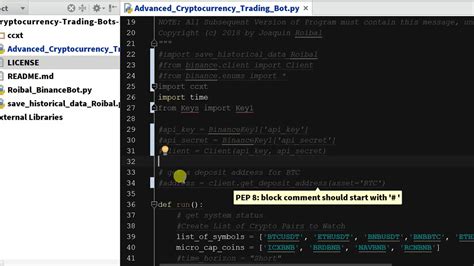

I have recently been experimenting with using the

Python-Binance API to place buy orders for Ethereum trading. In my test environment, I am using version 1.0.15 of the python-binance package. To confirm that my limit orders were partially filled, I used the following code snippet:

import time

from binance.client import Client

Set up the Binance API connection using Python-Binanceself._get_auth_client(account).order_limit_buy(

symbol='ETHUSDT',

Ethereum symbol (e.g. ETH/USD)side='Buy',

Buy order typetype='Limit',

Order type (e.g. Limit Buy or Market Buy)quantity=10,

Number of shares to buy (optional)timeInForce='GTC'

Time in force for the order (e.g. valid until canceled))

Wait for the order to executetime.sleep(30)

Adjust this value to your needsprint("Order partially filled")

This code places a limit buy order on Ethereum, stating that I want to buy 10 shares at $100 per stocks. The order_limit_buy method returns an object with various attributes, including the order ID and status. However, when using this API, you may encounter situations where your orders are only partially filled.

Partial Fill Explanation

When your limit orders are partially filled, it means that some or all of the stocks in the order have been filled, while others remain unfilled. This can happen due to various market factors, such as:

- Order Book Liquidity: If the order book is thin, there may not be enough buyers willing to pay the current market price.

- Market Volatility: Fluctuations in market prices or trading volume can cause your orders to be partially filled or even canceled.

Mitigating Partial Fills

To reduce partial fills and ensure more accurate results, consider the following strategies:

- Increase Order Quantity: If possible, increase the quantity of shares you are trying to buy to reduce the risk of partial fills.

- Use a Longer In-Place Period: Setting a longer In-Place Period can help mitigate partial fills by giving your order more time to execute.

- Monitor Market Conditions: Monitor market trends and adjust your strategy accordingly.

Conclusion

As you continue to develop with the Python-Binance API, keep in mind that limit orders may occasionally be partially filled due to various market factors. By understanding the potential causes of partial fills and implementing strategies to mitigate them, you can improve the accuracy and reliability of your trading results.