Optimizing the Future of Finance: Scaling, Risk Management, and Market Order Issues in Crypto

The rise of digital currencies has ushered in a new era of innovation and disruption in the financial world. However, one of the biggest challenges facing cryptocurrency market makers, brokers, and traders is scalability. As the number of active users continues to grow, the demand for more efficient and reliable systems that can handle increasing transaction volumes is increasing.

Scaling: The Key to Growth

One of the key challenges in scaling cryptocurrencies is the need for faster and more reliable transactions. This means that the time it takes for a buyer to confirm their order is reduced, which directly affects the speed at which buyers can execute transactions. To solve this problem, market makers need to implement scalable solutions that can process multiple orders simultaneously.

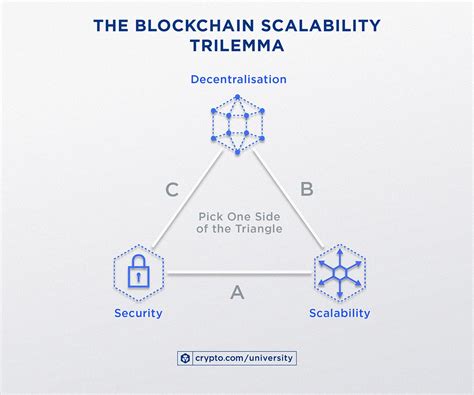

Blockchain Scalability

The underlying blockchain technology is designed to allow transactions to be executed quickly and securely without intermediaries. However, current blockchains have limitations when it comes to scalability. For example, Ethereum’s block time is around 15 seconds. While this may not seem like much by today’s standards, this can lead to delays that are unacceptable for high-frequency traders and market makers.

To overcome these limitations, blockchain developers must prioritize scalability. One solution being considered is sharding, which involves breaking the blockchain into smaller, independent sub-blockchains that can process multiple transactions at once. This approach has already been implemented in some cryptocurrency projects, such as Polkadot and Cosmos.

Risk Management: Protecting Your Investment

As with any investment, risk management is a crucial component of successful cryptocurrency trading. Scaling issues that are not properly managed can quickly lead to losses. It is therefore essential that market makers implement sound risk management strategies that address the following key risks:

- Order Book Stress: Ensuring order book integrity and mitigating the impact of sudden changes in market conditions.

- Market Volatility: Developing strategies to mitigate potential losses due to price fluctuations.

- Regulatory Risk: Staying abreast of regulatory updates and adapting trading strategies accordingly.

Market Order: The Final Piece of the Puzzle

A well-planned market order is essential for effective trading and minimizing losses. When properly implemented, it can help:

- Reduce Slippage: Minimize the time difference between a buyer’s order and its execution.

- Improve fill rates: Increase the likelihood that orders will be filled at the correct price.

- Increase liquidity: Give buyers access to more liquid markets and reduce the risk of losing trades.

Risk mitigation: Market order strategies

To reduce the risk of market orders, traders can employ a variety of strategies, including:

- Market making

: The accumulation of buy and sell orders to create a market for a specific asset.

- Risk management tools: The use of algorithms that automatically adjust the market maker’s trading strategy based on market conditions.

- Hedging

: The implementation of position limits or stop loss orders to limit potential losses.

Conclusion

The future of finance is promising, but it also has unique challenges. To unlock growth and reduce risk, cryptocurrency market makers must prioritize scalable solutions that can handle increasing transaction volumes. By implementing sound risk management strategies and leveraging scalable technologies like sharding, traders can make informed decisions and reduce their exposure to market volatility.